Qualifications Required for State Bank of India 1040 Various Job Vacancies

1. Post: Central Research Team (Product Lead)

Educational

Qualification

(As on 01.04.2024)

Mandatory: MBA/PGDM/PGDBM from Government recognized University or Institution or CA/CFA

Preferred Qualification: Preferred: NISM Investment Advisor/Research Analyst Certificate/CFP/NISM 21A or 21B

Post-Qualification

Experience

(As on 01.04.2024)

? Mandatory: Post Qualification Experience of Minimum 5 years in Equity Research/Products experience in

Wealth Management/AMC (Mutual Fund)/Banks.

? Preferred:

i. Minimum 8 years’ experience in Equity/Fixed Income Research/MF Research Analytics

ii. Excellent Knowledge on local and global economic trends

iii. Excellent Knowledge on local Primary/Secondary Equity Markets/Fixed Income and on PMS/AIF/MF/

Structured Products schemes in India.

iv. Experience in creating views and research-based publication on capital Market / sector trends.

v. Proficiency in using Excel / Modelling techniques / Bloomberg / Reuters /Morning Star / CRISIL data

bases.

vi. Flair for equity, understanding of all exchange traded products including bonds, INVIT, MLDs, REITs,

Section 54 EC Bonds.

Specific Skills required

(if any) Nil

Job profile

? The Official would work closely with Head – (Product, Investment & Research) and would be responsible for

running program of wealth products and liaise with Market data Aggregators and Research providers.

? The Official will be responsible to prepare product notes, market updates, investment outlook and evaluate

latest product offering in addition handling all queries related to products.

? He will also require to prepare notes related to products.

Key Responsibility

Areas

The Official would work closely with Head – (Product, Investment & Research) and conduct the following activities:

? Understand the current trends of wealth products.

? Create forward looking view on equity market and specific sectors.

? Give regular updates on developments in equity market.

? Analyse various PMS/AIF/MF/Structured Products/ scheme offerings and conduct due diligence prior to

approval.

? Liaise with other departments and outside agencies for

equity markets.

? Analytics of Equity PMS/AIF/Other wealth product and Client portfolios.

? Liaise with Market data aggregators and research report providers.

? Regular interaction with Investment and RM teams.

? Any other matter, as may be entrusted by the Bank from time to time.

B. REMUNERATION & CONTRACT PERIOD:

C. DETAILS OF THE REQUIREMENTS OF EDUCATIONAL QUALIFICATIONS/POST-QUALIFICATION EXPERIENCES/SPECIFIC

SKILLS /JOB PROFILE/KEY RESPONSIBILITY AREA ETC:

2. Post: Central Research Team (Support)

Educational

Qualification

(As on 01.04.2024)

Mandatory: Graduate/Post-Graduate in Commerce/Finance/Economics/Management/Mathematics/Statistics from

Government recognized University or Institution.

Post-Qualification

Experience

(As on 01.04.2024)

Mandatory: Post Qualification Experience of Minimum 3 years in financial services providing support to Research /

Publications department.

Specific Skills

required (if any)

Preferred:

i. Candidate should be proficient in Microsoft Excel, Power point, Word, Outlook.

ii. Candidate should have inclination to undertake research by reading various reports or websites.

iii. Candidate should be able to support Research team by aggregating and providing support for analysing

data through various research tools / software like BLOOMBERG, REUTERS, CRISIL, ICRA etc.

Job profile

Role will include creating and updating excel worksheets related to: Macro Economy, Stock & Sector research, Fixed

Income research, creating portfolio review templates etc.

Key Responsibility

Areas

? Creating and updating excel worksheets related to:

o Macro Economy

o Stock & Sector research

o Fixed Income research

o Mutual Fund, PMS & other products research

o Model portfolios

? Creating portfolio review templates which are used in order to support Investment Counsellors and Relationship

Managers

? To prepare portfolio review templates and to support Investment Counsellors and Relationship Managers

? To work closely with the research team in terms of designing as well as rolling out daily, weekly, monthly

publications / presentations on regular basis.

3. Post: Project Development Manager (Technology)

Educational

Qualification

(As on 01.04.2024)

Mandatory: MBA/MMS/PGDM/ME/M.Tech./BE/B.Tech./PGDBM from Government recognized University or

Institution.

Post-Qualification

Experience

(As on 01.04.2024)

Mandatory: Minimum 4 years’ post qualification experience in banking Technology preferably in a business function.

Specific Skills required

(if any) Nil

Job profile

? Managing relationships with the technology partners.

? Understanding and communicating business requirements to the IT team and technology partners.

? Working closely with the banks’ IT teams to ensure timely completion of developments.

? Co-ordinating with various Bank IT teams and business teams for new developments, integrations or bug-fixes

in existing Bank platforms.

? Creating and documenting operating manuals for technology interfaces at user level.

Key Responsibility

Areas

? Managing relationships with the technology partners.

? Understanding and communicating business requirements to the IT team and technology partners.

? Working closely with the bank IT teams to ensure timely delivery of developments.

? Co-ordinating with various Bank IT teams and business teams for new developments, integrations or bugfixes in existing Bank platforms.

? Creation and documentation of operating manuals for technology interfaces at user level.

4. Post: Project Development Manager (Business)

Educational

Qualification

(As on 01.04.2024)

Mandatory: MBA/PGDM/PGDBM from Government recognized University or Institution

Post-Qualification

Experience

(As on 01.04.2024)

? Mandatory: Post Qualification Experience of Minimum 5 years in Bank/wealth Management firms/broking

firms.

? Preferred: Experience in Supervisory function in Business Process Management in Wealth Management

area.

Specific Skills required

(if any) Nil

Job profile

? Managing Relationships with various Business Partners

? Exploring and entering into new Business partnerships for existing as well as new Business streams

? Working closely with the Business Heads on strategy formulation and reporting to top Management.

? Co-ordinating with the Business Operation Team and Circle teams during rollout

? Creating and documenting standard operating processes to be followed for existing and new Business lines

Key Responsibility

Areas

? Monitor activities essential to sales force.

? Drive CRM and Implement.

? Sales force automation like FD roll over project, inflow outflow management, capacity plan.

? Manage process implementation through sales team and back-office teams.

? Manage and customize design and deliver wealth proposition to chosen segments.

? Sales and Client education programmes.

? Helping annual planning and budgeting.

? Managing P&L, Support business head in prioritizing growth expenses.

? Establish business review process and parameters.

? Track industry trends, structure, market players and other competitors.

? Liaise with internal bank teams for better TATs and proposition of Wealth.

? Design business processes and policies encompassing entire client life cycle

? Working with HR to provide assistance and clarify the application of sales compensation policies.

? Support sales head in developing and launching initiatives to analyse the existing activity as well as new

market activities.

? Any other matter, as may be entrusted by the Bank from time to time

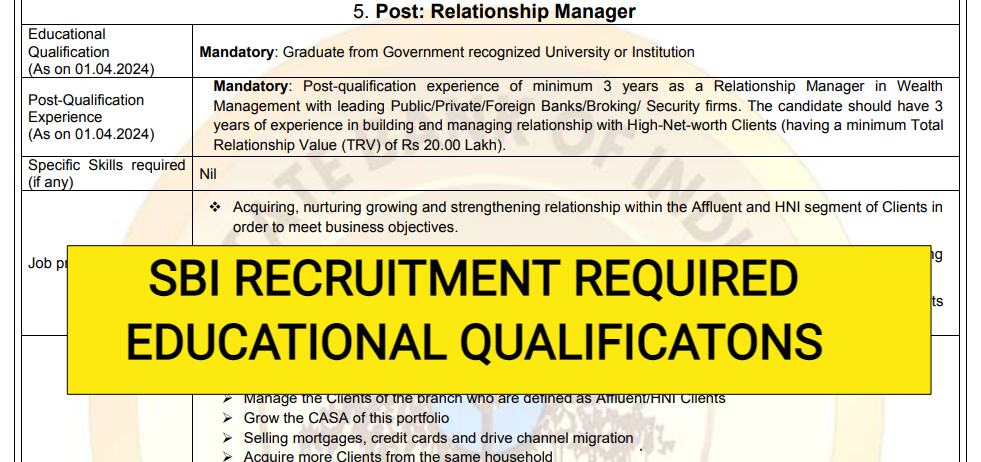

5. Post: Relationship Manager

Educational

Qualification

(As on 01.04.2024)

Mandatory: Graduate from Government recognized University or Institution

Post-Qualification

Experience

(As on 01.04.2024)

Mandatory: Post-qualification experience of minimum 3 years as a Relationship Manager in Wealth

Management with leading Public/Private/Foreign Banks/Broking/ Security firms. The candidate should have 3

years of experience in building and managing relationship with High-Net-worth Clients (having a minimum Total

Relationship Value (TRV) of Rs 20.00 Lakh).

Specific Skills required

(if any) Nil

Job profile

? Acquiring, nurturing growing and strengthening relationship within the Affluent and HNI segment of Clients in

order to meet business objectives.

? Selling a range of Investment and Insurance products to these Clients in order to meet their financial planning

objectives and thus attaining the revenue objectives of the Wealth Management business.

? Focusing on increasing the Total Relationship Value (TRV) and Assets Under Management (AUM) of Clients

as per the business objectives

Key Responsibility

Areas

? Acquire HNI and Affluent Clients

? Deepen Relationships:

? Manage the Clients of the branch who are defined as Affluent/HNI Clients

? Grow the CASA of this portfolio

? Selling mortgages, credit cards and drive channel migration

? Acquire more Clients from the same household

? Service these Clients.

? Increase product per customers (PPC) with reference to Wealth products as well as Bank products.

? Wealth Management:

? Do a Financial Needs Analysis and Risk Profiling for the Clients in the portfolio.

? Periodic Portfolio reviews for all Clients

? Selling investments, life insurance, general insurance and SIP.

? Ensure all Clients have a CASA for routing their investments.

? Compliance:

? Ensure AMFI, IRDA and NISM certification

? Ensure all Client instructions are executed the same day

? Ensure 100% documentation of all transactions.

? Branch Development

? Conduct branch Insurance & Investment seminars to spread financial awareness

? Any other matter, as may be entrusted by the Bank from time to time

6. Post: VP Wealth

Educational

Qualification

(As on 01.04.2024)

Mandatory: Graduate from Government recognized University or Institution.

Preferred: MBA (Banking/Finance/Marketing) with 60% from recognized University or Institution.

Post-Qualification

Experience

(As on 01.04.2024)

Mandatory: Post Qualification Experience of minimum 6 years as a Relationship Manager in Wealth Management

with leading Public/Private/Foreign banks/Broking/ Security firms. The candidate should have adequate

experience in building and managing relationship with Ultra High Net Worth Clients (having a minimum Total

Relationship Value (TRV) of Rs 100.00 Lakh).

Specific Skills required

(if any) Nil

Job profile ? Acquiring, nurturing growing and strengthening relationship within the Affluent and UHNI/HNI segment of

Clients in order to meet business objectives

? Cross Selling a range of Investment, Insurance products and other Asset Classes to these Clients in order

to meet their financial planning objectives and thus attaining the revenue objectives of the Wealth

Management business

? Focusing on increasing the Total Relationship Value (TRV), Assets Under Management (AUM), Investment

AUM & Increase in Product per Clients as per the business objectives

Key Responsibility

Areas

? Acquire UHNI/HNI and Affluent Clients

? Deepen Relationships

? Manage the Clients of the branch who are defined as Affluent/UHNI/HNI Clients

? Grow the CASA/Investment AUM of this portfolio & Other Asset Classes

? Cross-sell mortgages, credit cards and drive channel migration

? Acquire more Clients from the same household

? Service these Clients.

? Increase product per customers (PPC) with reference to Wealth products as well as Bank products.

? Wealth Management:

? Do a Financial Needs Analysis and Risk Profiling for the Clients in the portfolio.

? Periodic Portfolio reviews for all Clients

? Cross-Sell investments, life insurance, general insurance, PMS, SIP and any new investment product.

? Compliance:

? Ensure AMFI, IRDA, NISM and all other relevant certification

? Ensure all Client instructions are executed the same day

? Ensure 100% documentation of all transactions.

? Branch Development:

? Conduct branch Insurance & Investment seminars to spread financial awareness

? Any other matter, as may be entrusted by the Bank from time to time

7. Post: Relationship Manager – Team Lead

Educational

Qualification (As on

01.04.2024)

Mandatory: Graduate from Government recognized University or Institution.

Post-Qualification

Experience (As on

01.04.2024)

? Mandatory: Post qualification experience of minimum 8 years in relationship management in wealth

management with leading Public/Private/Foreign banks/Broking/ Security firms.

? Preferred: Experience as a Team Lead is preferred.

Specific Skills required

(if any) Nil

Job profile

? Managing a team of Relationship Mangers for the Wealth Management Business

? Acquiring, nurturing growing and strengthening relationship within the Affluent and HNI segment of Clients in

order to meet business objectives

? Selling a range of Investment and Insurance products to these Clients in order to meet their financial planning

objectives and thus attaining the revenue objectives of the Wealth Management business

? Focusing on increasing the Total Relationship Value (TRV) and Assets Under Management (AUM) of Clients

as per the business objectives

Key Responsibility

Areas

? Acquire HNI and Affluent Clients

? Managing the team of Relationship Mangers and ensuring the team achieves its targets

? Ensuring compliance of guidelines, systems & procedures by the Relationship Manager team

? Allocation of leads and Clients to appropriate team members

? Increase product per customers (PPC) with reference to Wealth products as well as Bank products.

? Deepen Relationships

? Manage the Clients of the Bank who are defined as Affluent/HNI Clients

? Grow the CASA of this portfolio

? selling mortgages, credit cards and drive channel migration

? Acquire more Clients from the same household

? Service these Clients.

? Wealth Management

? Do a Financial Needs Analysis and Risk Profiling for the Clients in the portfolio.

? Periodic Portfolio reviews for all Clients

? Selling investments, life insurance, general insurance and SIP.

? Ensure all Clients have a CASA for routing their investments.

? Compliance

? Ensure all Client instructions are executed the same day

? Ensure 100% documentation of all transactions.

? Branch Development

? Conduct branch Insurance & Investment seminars to spread financial awareness.

? Any other matter, as may be entrusted by the Bank from time to time

8. Post: Regional Head

Educational

Qualification (As on

01.04.2024)

Mandatory: Graduate from Government recognized University or Institution.

Post-Qualification

Experience (As on

01.04.2024)

? Mandatory:

i. Post Qualification Experience of Minimum 12 years of experience in relationship management in wealth

management with leading Public/Private/Foreign Banks/Broking/Security firms.

ii. Post Qualification minimum 5 years of experience in leading a large team of Relationship Managers or a

Team Lead in Wealth Management is mandatory.

Specific Skills required

(if any) Nil

Job profile

? Managing a team of Relationship Managers & RM (Team Lead)s & Investment Officers for the Wealth

Management Business of the allotted Circle(s)

? Achieving the target of the team to Acquire, nurturing growing and strengthening relationship within the

Affluent and UHNI/HNI segment of Clients in order to meet business objectives

? Cross Selling a range of Investment, Insurance products and other Asset Classes to these clients in order to

meet their financial planning objectives and thus attaining the revenue objectives of the Wealth Management

business of the allotted Circle(s)

? Focusing on increasing the Total Relationship Value (TRV), Assets Under Management (AUM), Investment

AUM & Increase in Product per Clients as per the business objectives

Key Responsibility

Areas

? Acquire HNI and Affluent Clients

? Managing the team of Relationship Mangers, Team Leads & Investment Officers and ensuring the team

achieves its target

? Ensuring compliance of guidelines, systems & procedures by the Relationship Managers/ RM (Team

Lead)/Investment Officers

? Allocation of leads and Clients to appropriate team members

? Increase product per customers (PPC) with reference to Wealth products as well as Bank products.

? Deepen Relationships

? Manage the Clients of the Bank who are defined as Affluent/UHNI/HNI Clients

? Grow the CASA/Investment AUM of this portfolio & Other Asset Classes

? Cross-sell mortgages, credit cards and drive channel migration

? Acquire more Clients from the same household

? Service these Clients.

? Monitoring Financial Needs and Risk Profiling of the Clients.

? Monitoring Periodic Portfolio reviews for all Clients

? Monitoring Proper Mapping of Clients to team.

? Ensuring Certification of Training of Team members.

? Ensure Leave Discipline among the Team/proper maintenance of visit records

? Complaint Management: Timely redressal of Client complaints

? Branch Development

? Conduct Client Meet, seminars and Investment conclave to spread financial awareness.

? Any other matter, as may be entrusted by the Bank from time to time

9. Post: Investment Specialist

Educational

Qualification (As on

01.04.2024)

? Mandatory:

i. MBA/PGDM/PGDBM from recognized College/University or CA/CFA

ii. Certification by NISM 21A (Valid)

? Preferred: CA/CFP/NISM Investment Advisor / Research Analyst Certificate

Post-Qualification

Experience (As on

01.04.2024)

Mandatory: Minimum 6 years of post-qualification experience as an investment advisor/counsellor/officer/part of

product team in Wealth Management organization

Specific Skills required

(if any)

Preferred:

i. Good knowledge of investments and markets across asset classes.

ii. Experience in managing and advising client portfolios.

iii. Good knowledge of asset allocation and re-balancing techniques.

iv. Superior presentation skills & other core competencies like leadership and teamwork.

v. Experience in products of fixed income, equity and alternate markets.

Job profile

? Guiding clients on range of financial services products

? Wide ranging experience across categories such as: MF, FI, Structured Products, Discretionary Portfolios

and other Alternate Products.

? Strong focus on due diligence, quantitative technique and asset allocation

Key Responsibility

Areas

? Assisting the VP Wealth/ Relationship Manager/ RM Wealth in providing expert opinion regarding

investments

? Work closely with VP Wealth/RMs / RM Wealth to their clients for creation and implementation of their

financial needs.

? Prepare presentations for VP Wealth/RMs / RM Wealth and clients on Investment products and view on the

market.

? Help in providing incidental advice to clients. Provide generic information on taxation of products.

? Research and investigate new investment opportunities to determine relevance for clients

? Guiding the Clients on the right investment products based on their needs and Improving Client’s

understanding of complex and structured products. Answer clients’ questions about the purposes and

details of financial options and strategies referred to by VP Wealth/RMs / RM Wealth.

? Research / create house view on investment products and market.

? Coaching and regularly updating the VP Wealth/RMs/ RM Wealth team on latest developments and

investment products.

? Wealth Management

? Do a Financial Needs Analysis and Risk Profiling for the Clients.

? Periodic Portfolio reviews for all Clients

? Compliance

? Ensure AMFI, IRDA and NISM certification

? Any other matter, as may be entrusted by the Bank from time to time

10. Post: Investment Officer

Educational Qualification (As on 01.04.2024)

? Mandatory:

i. MBA/PGDM/PGDBM from recognized College/University or CA/CFA

ii. Certification by NISM 21A

? Preferred: CA/CFP/NISM Investment Advisor / Research Analyst Certificate

Post-Qualification

Experience (As on

01.04.2024)

Mandatory: Minimum 4 years of post-qualification experience as an investment advisor/counsellor/officer/part of

product team in Wealth Management organization

Specific Skills required

(if any)

Preferred:

i. Good knowledge of investments and markets across asset classes.

ii. Experience in managing and advising client portfolios.

iii. Good knowledge of asset allocation and re-balancing techniques.

iv. Superior presentation skills & other core competencies like leadership and teamwork.

v. Experience in products of fixed income, equity and alternate markets.

Job profile

? Guiding clients on range of financial services products

? Wide ranging experience across categories such as: MF, FI, Structured Products, Discretionary Portfolios

and other Alternate Products.

? Strong focus on due diligence, quantitative technique and asset allocation

Key Responsibility

Areas

? Assisting the VP Wealth/ Relationship Manager/ RM Wealth in providing expert opinion regarding

investments

? Work closely with VP Wealth/RMs/RM Wealth for creation and implementation of their financial needs.

? Prepare presentations for VP Wealth/RMs/RM Wealth and clients on Investment products and view on the

market.

? Help in providing incidental advice to clients. Provide generic information on taxation of products.

? Research and investigate new investment opportunities to determine relevance for clients

? Guiding the Clients on the right investment products based on their needs and Improving Client’s

understanding of complex and structured products. Answer clients’ questions about the purposes and details

of financial options and strategies referred to by VP Wealth/RMs/RM Wealth

? Research / create house view on investment products and market.

? Coaching and regularly updating the VP Wealth/RMs/RM Wealth team on latest developments and

investment products.

? Wealth Management

? Do a Financial Needs Analysis and Risk Profiling for the Clients

? Periodic Portfolio reviews for all Clients

? Compliance

? Ensure AMFI, IRDA and NISM certification

? Any other matter, as may be entrusted by the Bank from time to time

SBI Recruitment 2024- Important Points

| Vacancy Details | ||||

| Specialist Cadre Officer (SO) | ||||

| SI No | Post Name | Total | Age Limit (as on 01-04-2024) | Qualification |

| 1. | Central Research Team (Product Lead) |

02 | 30 – 45 Years | CA/CFA or MBA/PGDM/PGDBM |

| 2. | Central Research Team (Support) |

02 | 25 – 35 Years | Degree/ PG (Commerce/ Finance /Economics/ Management/ Mathematics/ Statistics) |

| 3. | Project Development Manager (Technology) |

01 | 25 – 40 Years | BE/B.Tech./MBA/MMS/PGDM/ME/M.Tech./PGDBM |

| 4. | Project Development Manager (Business) |

02 | 30 – 40 Years | MBA/PGDM/PGDBM |

| 5. | Relationship Manager | 273 | 23 – 35 Years | Any Degree |

| 6. | VP Wealth + | 643 | 26 – 42 Years | |

| 7. | Relationship Manager – Team Lead |

32 | 28 – 42 Years | |

| 8. | Regional Head | 06 | 35 – 50 Years | |

| 9. | Investment Specialist | 30 | 28 – 42 Years | CA/CFA or MBA/PGDM/PGDBM, Certification by NISM 21A |

| 10. | Investment Officer | 49 | 28 – 40 Years | |

ONLINE REGISTRATION OF APPLICATION & PAYMENT OF FEES: FROM 19.07.2024 TO 08.08.2024

Important Dates

|

| Apply Online | Click Here | |||

| Notification | Click Here | |||

| Official Website | Click Here | |||

Today’s Job Updates

Join Engineering Job Alert Telegram Channel- Join Now

Join All Govt Job Alerts Telegram Channel to receive job updates- Join Now

More Engineering Jobs– Listed Below